LCQ22: Operation of financial regulators

Question by the Hon Chan Chun-ying :

It is learnt that since December 2002, the four financial regulators in Hong Kong (i.e. the Hong Kong Monetary Authority, the Securities and Futures Commission, the Insurance Authority and the Mandatory Provident Fund Schemes Authority) have adopted a frontline regulator approach to oversee the cross-segment business of financial institutions. In order to minimize regulatory duplication or gaps, the four financial regulators have signed a series of memoranda of understanding (“the MoUs”) amongst themselves; the Government has also established the Council of Financial Regulators (“CFR”) whose terms of reference are, among others, to “minimize duplication or gaps in the regulation and supervision of financial institutions, paying close attention to the need to keep regulatory costs to a minimum”, and “review international developments in financial sector regulation and to draw lessons for Hong Kong”. In this connection, will the Government inform this Council:

(1)whether it knows if the aforesaid four financial regulators have regularly conducted reviews on and made amendments to the MoUs; if they have, of the details; if not, the reasons for that;

(2)whether CFR has, since its establishment, held discussions on the aforesaid “paying close attention to the need to keep regulatory costs to a minimum” and made corresponding decisions; if so, of the details; if not, the reasons for that; and

(3)as it is learnt that the United Kingdom has implemented a “twin peaks” financial regulatory regime since April 2013, whether CFR has explored the lessons that Hong Kong can draw from it; if so, of the details; if not, the reasons for that?

Reply by the Secretary for Financial Services and the Treasury, Mr Christopher Hui:

In consultation with the concerned financial regulators, my consolidated reply to the question is as follows.

With the objectives of contributing to the efficiency and effectiveness of regulation and supervision of financial institutions, fostering the promotion and development of the financial market, and facilitating the maintenance of financial stability, the Government has established the Council of Financial Regulators (“the Council”). The Council is chaired by the Financial Secretary, with members from the financial regulators including the Hong Kong Monetary Authority (“HKMA”), Securities and Futures Commission (“SFC”), Insurance Authority (“IA”), Mandatory Provident Fund Schemes Authority (“MPFA”) and Accounting and Financial Reporting Council (“AFRC”).

The terms of reference of the Council include facilitating cooperation and coordination among its members; sharing information and views on regulatory and supervisory issues and important trends in the financial system; and minimising duplication or gaps in the regulation and supervision of financial institutions, paying close attention to the need to keep regulatory costs to a minimum. Council members have conducted close exchanges on regulatory and supervisory cooperation and coordination in light of the latest developments in the financial market, with a view to ensuring financial stability while minimising compliance costs of financial institutions as far as possible, thereby facilitating the healthy development of the financial market.

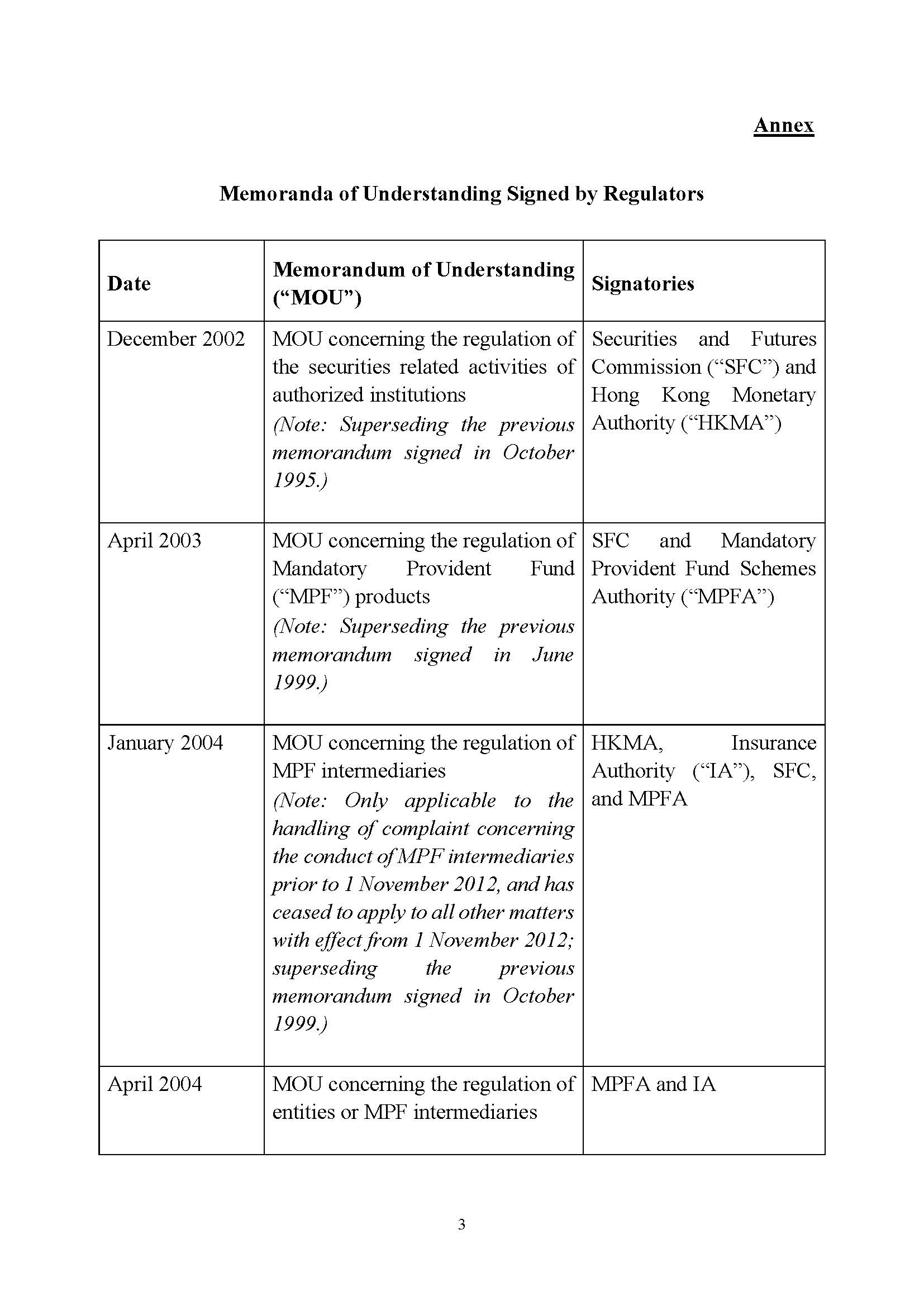

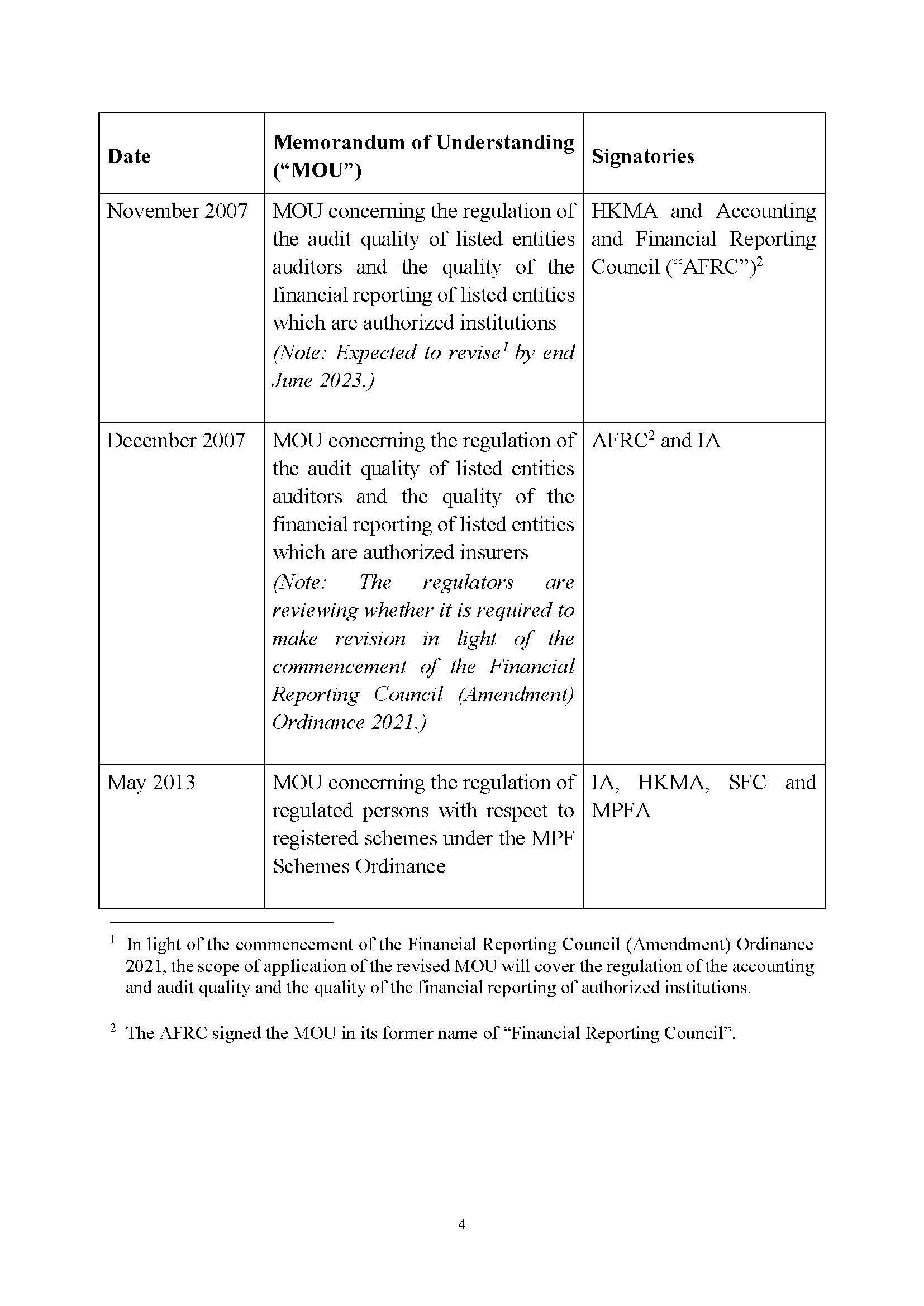

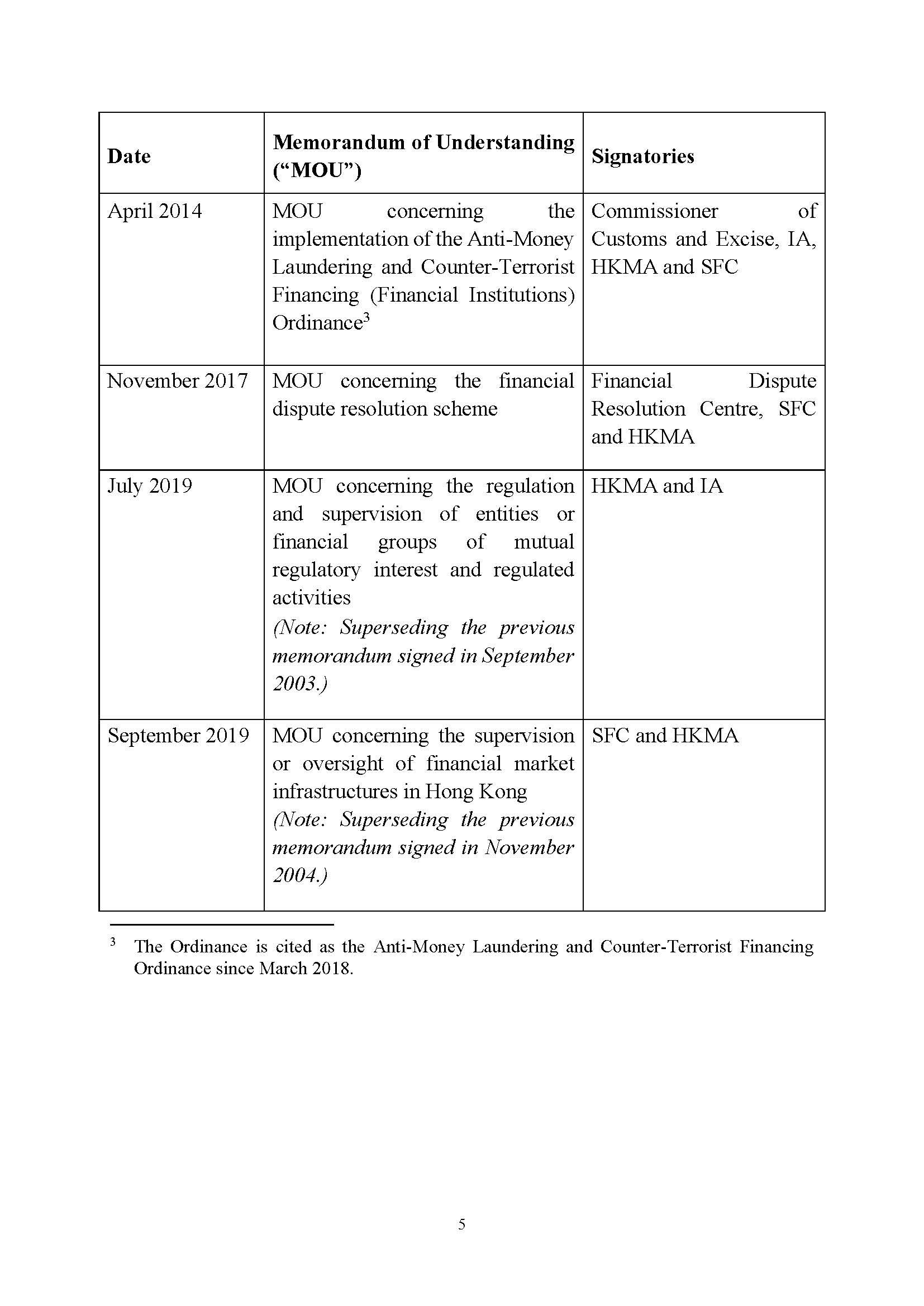

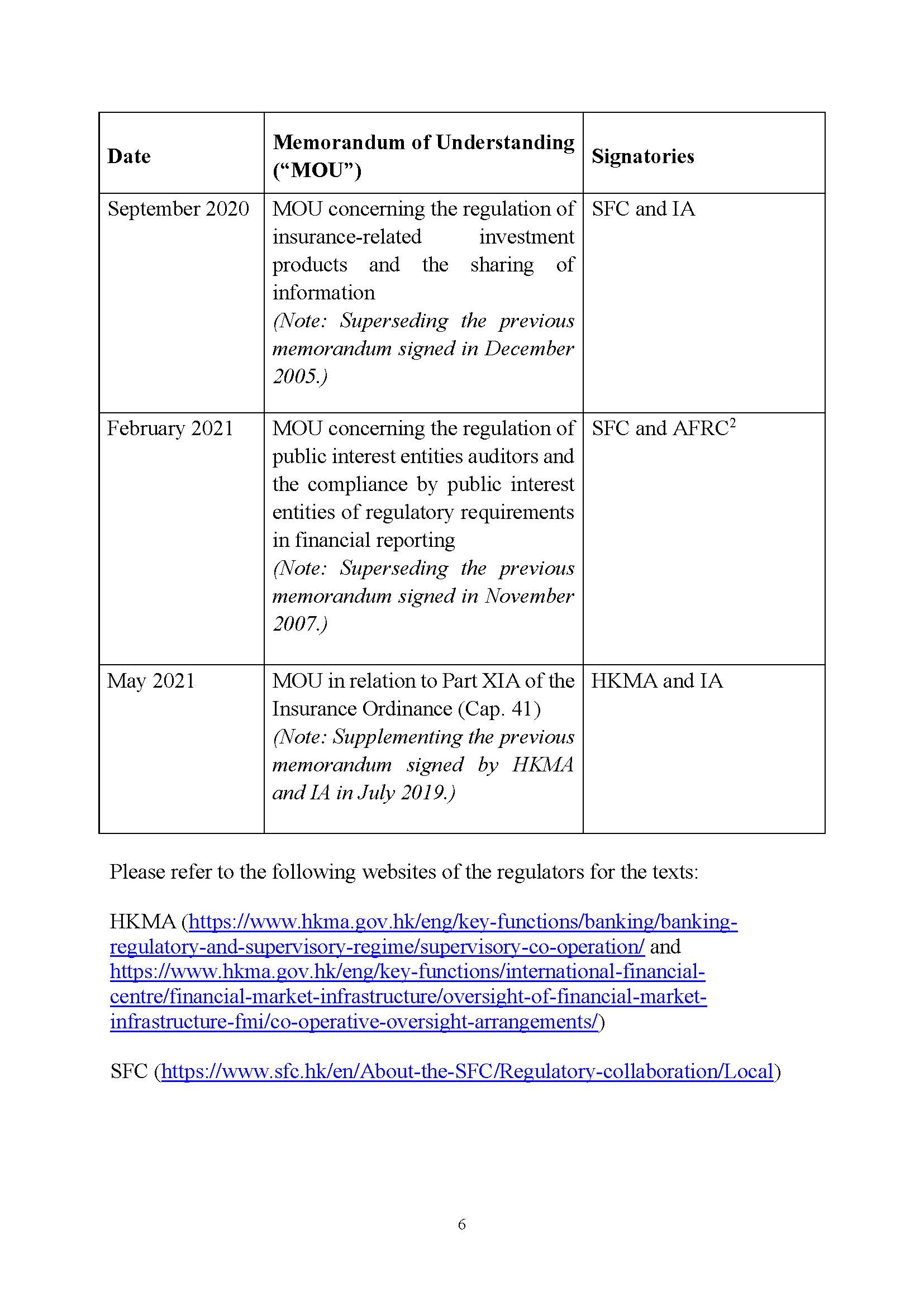

In addition, the regulators have maintained communication on regulatory issues of common concern and entered into memoranda of understanding (“MOUs”) with reviews and updates from time to time. These MOUs provide supplementary information on the functions and division of work among the regulators; set out the framework for mutual assistance, information exchange and bilateral meetings; and further strengthen communication and cooperation among the regulators. A list of the MOUs entered into by respective regulators is at Annex.

There is no established international standard for financial regulatory structure or model. Currently, Hong Kong adopts an “institution-based” regulatory model, where the regulators adopt prudential regulatory measures having regard to the actual situation of their respective regulatees and sectors. Not only can the regulators focus on the development and risks of their regulated sectors and effectively address market needs, but they can also complement one another’s knowledge and experience. The regulators exchange views on an ongoing basis, undertake joint actions (e.g. promulgating joint guidelines and examining themes of common interest), and collaborate on compliance and enforcement matters.

Through such platforms as the Council, the regulators coordinate efforts and conduct division of work on cross-organisation and cross-sector issues. They also collaborate through MOUs, and explore new areas of cooperation in light of the ever-evolving regulatory landscape, thereby catering for the regulation and development of different financial sectors, and jointly maintaining financial stability.

The Government and financial regulators have been monitoring the development of the global financial market and financial regulatory systems, so as to identify room for improvement. The Government is open to suggestions for enhancing regulatory efficiency, promoting market development and assisting in maintaining market stability. Any reform to the financial regulatory regime must take into account Hong Kong’s unique environment and market needs. Prudence in action having regard to all relevant factors is needed.