LCQ18: Cross-boundary Wealth Management Connect Scheme in the Guangdong-Hong Kong-Macao Greater Bay Area

Question by the Hon Chan Chun-ying :

The Cross-boundary Wealth Management Connect (“WMC”) Scheme in the Guangdong-Hong Kong-Macao Greater Bay Area was officially launched in September 2021 while “WMC 2.0” officially commenced on 26 February this year. It has been reported that in March this year, the number of new Mainland investors participating in the Southbound Scheme increased by nearly 12 times month-on-month and the amount of cross-boundary fund remittances involved also increased by 7.9 times month-on-month, but there was no significant increase in these figures under the Northbound Scheme. The Hong Kong Monetary Authority has pointed out that this was mainly due to the different interest rate environment between the Mainland and Hong Kong as well as the different financial management needs of the residents in the two places (e.g. Hong Kong residents already have many channels to diversify their investments). In this connection, will the Government inform this Council:

(1) as it has been reported that as at the end of March this year, over 98% of the market value of Hong Kong and Macao investment products held by Mainland investors under the Southbound Scheme were deposits, while some members of the financial sector expect that the US Federal Reserve may start cutting rates in the second half of this year, whether the Government has reviewed the attractiveness of other investment products under the Southbound Scheme (e.g. funds and bonds), with a view to maintaining the development momentum of the Southbound Scheme; if so, of the details; if not, the reasons for that;

(2) whether it has conducted studies on the categories of products and the selling process under the Northbound Scheme and put in place enhancement measures to attract more Hong Kong investors to participate in the Northbound Scheme; if so, of the details; if not, the reasons for that; and

(3) whether the relevant policy bureaux and regulatory bodies have communicated with the relevant Mainland authorities on the implementation of the Cross-boundary WMC Scheme on a regular basis; if so, of the details; if not, the reasons for that?

Reply by the Secretary for Financial Services and the Treasury, Mr Christopher Hui

Cross-boundary Wealth Management Connect (WMC) in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) provides GBA residents with a formal, direct and convenient channel for cross-boundary investment in diverse wealth management products and marks a milestone in the financial development of the GBA.

WMC has seen continuous and steady development since its launch in September 2021. “WMC 2.0” commenced on February 26, 2024. Enhancement measures include increasing the individual investor quota from RMB1 million to RMB3 million, lowering the threshold for participating in the Southbound Scheme to support more GBA residents to participate in the scheme, expanding the scope of participating institutions to include eligible securities firms, expanding the scope of eligible investment products, and further enhancing the promotion and sales arrangements. According to the statistics published by the People’s Bank of China (PBOC), up to end-April 2024, over 110 000 individual investors in the GBA participated in WMC and cross-boundary fund remittances (including Guangdong, Hong Kong and Macao) amounting to over RMB50.7 billion had been recorded.

My reply to the question raised by Hon Chan is as follows:

(1) Under “WMC 2.0”, the scope of eligible products under the Southbound Scheme has been expanded to include all “non-complex” funds domiciled in Hong Kong and authorised by the Securities and Futures Commission in Hong Kong (SFC) that primarily invest in Greater China equity, as well as low- to medium-high-risk (which was low- to medium-risk under “WMC 1.0”) “non-complex” funds domiciled in Hong Kong and authorised by the SFC (excluding high-yield bond funds and single emerging market equity funds). The number of funds distributed by Hong Kong banks under the Southbound Scheme has nearly doubled, from around 160 before the expansion to around 300. At current stage, the eligible products covered by the Southbound Scheme of WMC are relatively comprehensive and could cater for the risk appetites of WMC individual investors, providing Mainland individual investors with a wide range of investment options that meet diverse investment needs.

We have been maintaining close communication with the industry and the Mainland regulatory authorities in facilitating Hong Kong financial institutions’ better understanding of the operational details of the enhancement measures, thereby ensuring the effective implementation of “WMC 2.0”. We are also working with the industry to step up investor education in the GBA, so as to enhance investors’ knowledge of WMC and products concerned, and enable them to better capture the cross-boundary wealth management and investment opportunities.

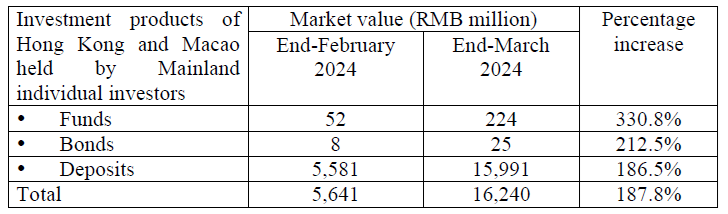

According to the statistics published by the PBOC, up to end-March 2024, investment products of Hong Kong and Macao held by Mainland individual investors under the Southbound Scheme of WMC stood at around RMB16.24 billion, representing an increase of 1.8 times compared to the end-February figure. Allocation in funds and bonds increased, with details tabulated as follows:

We are communicating with the industry and the Mainland regulatory authorities closely, and continuously reviewing the implementation of “WMC 2.0” with a view to exploring further expansion of the product scope under the Southbound Scheme.

(2) Under “WMC 2.0”, RMB-denominated deposit products offered by Mainland banks have been newly added to the scope of eligible products under the Northbound Scheme, and the scope of eligible public securities investment funds has been expanded from those with risk rating of “R1” to “R3” to those with risk rating of “R1” to “R4” (excluding commodity futures funds). This has appropriately increased the investment options and diversity for Hong Kong investors under the Northbound Scheme. Regarding promotion and sales arrangements, “WMC 2.0” has provided clarity in the sales arrangements for the Northbound Scheme that Mainland sales institutions could, upon the request of Hong Kong clients and after assessing clients’ risk tolerance, introduce to them Northbound products commensurate with their risk tolerance level.

We and the Mainland regulatory authorities will examine and enhance WMC continuously (including the product types and sales arrangements) with the aim of attracting more Hong Kong investors to participate in the scheme.

(3) The Hong Kong Monetary Authority (HKMA) and the SFC have been in close communication with the Mainland regulatory authorities on the implementation of WMC, covering the monthly WMC data, the latest progress of regulatory review in both places, feedback from investors in both places, and the suggestions from the industry on the implementation process, etc. The HKMA and the SFC, in co-ordination with the Mainland regulatory authorities, have also strengthened collaboration in business presentation and investor education so as to strengthen public awareness and understanding of WMC and products concerned in both the Mainland and Hong Kong.

As an innovative financial co-operation measure in the GBA involving three different regulatory systems, WMC has been implemented under a pilot approach in a gradual and incremental manner. The Government and the financial regulators will closely monitor market developments and the operation of WMC, collaborate with the Mainland authorities to jointly foster the smooth implementation of WMC and continuously explore further enhancement measures to increase investors’ choices.